Futures vs. Options Trading: Which Is Right for You?

When it comes to trading derivatives, two of the most popular instruments are futures and options. While both provide opportunities for speculation, hedging, and leveraging capital, they differ in key ways that make them suitable for different types of traders and strategies. If you're trying to decide between futures and options trading, this guide will help you understand the differences and choose the one that aligns best with your trading goals and risk tolerance.

What Are Futures Contracts?

Futures contracts are agreements between two parties to buy or sell an asset at a predetermined price on a specified future date. These contracts are standardized and traded on exchanges, covering assets such as commodities, stocks, bonds, and currencies.

Key Features of Futures Trading:

- Obligatory Commitment: Once you enter a futures contract, both the buyer and seller are obligated to fulfill the contract at expiration.

- Leverage: Futures require a margin deposit, allowing traders to control large positions with relatively small capital.

- No Time Decay: Unlike options, futures contracts do not lose value over time due to expiration concerns.

- Higher Risk Exposure: Since both profits and losses are amplified due to leverage, futures trading carries substantial risk.

Who Should Trade Futures?

Futures are ideal for traders who want to hedge against price fluctuations, such as farmers, manufacturers, and institutional investors. They are also suitable for those comfortable with high leverage and potential margin calls and for traders who prefer direct exposure to market price movements.

What Are Options Contracts?

Options are financial contracts that give traders the right, but not the obligation, to buy (call option) or sell (put option) an asset at a specified price before or on the expiration date.

Key Features of Options Trading:

- Limited Risk: The maximum loss for an options buyer is the premium paid.

- Flexible Strategies: Options provide various trading strategies, including spreads, straddles, and covered calls.

- Time Decay: Options lose value over time, especially as expiration approaches.

- Lower Margin Requirements: Compared to futures, options require lower capital investment.

Who Should Trade Options?

Options are well-suited for traders who prefer limited risk exposure and defined loss potential. They are ideal for those looking to generate passive income through selling covered calls, traders who enjoy creating complex strategies to hedge or speculate, and investors who want to profit from market volatility without direct asset ownership.

Watch me in action trading futures using a prop firm and trade copier

Comparing Futures and Options: Which Should You Choose?

Futures trading requires mandatory execution and carries higher leverage, making it riskier but potentially more rewarding for those who can manage market fluctuations. In contrast, options trading offers flexibility, limited risk for buyers, and a variety of strategies that can be tailored to different market conditions.

If you’re comfortable with high leverage, mandatory execution, and rapid market movements, futures trading might be for you. On the other hand, if you prefer flexibility, limited risk exposure, and strategic hedging, options trading could be a better fit.

Open a Robinhood Account to Start Trading Options

My Journey from Options to Futures Trading

My trading journey began with options. At first, I didn't fully grasp the difference between day trading options and LEAP options, but I quickly learned through trial and error. The first few months felt like a roller coaster ride—some wins, but many losses. Eventually, I started searching for a way to become profitable more efficiently. That’s when I discovered futures trading.

What surprised me most about futures trading was the availability of proprietary (prop) trading firms that offer funding to traders. Unlike options, where you have to use your own capital, many prop firms allow traders to access significant funding in exchange for a share of the profits. This makes futures trading an attractive choice for those looking to scale up quickly without risking large personal investments.

Another major advantage of futures trading is the abundance of free educational resources. There are numerous free Discord groups and YouTube communities where traders share insights and strategies. In contrast, most options trading communities operate within private Discord groups, often charging a hefty monthly fee of around $150 for daily trade callouts.

Additionally, the cost of education varies significantly between the two. Futures trading courses typically range from $199 to $500, making them relatively affordable for new traders. Options courses, on the other hand, often cost between $500 and $1,000, which can be a significant barrier for beginners.

Looking back, transitioning to futures trading was a game-changer for me. It provided me with more accessible resources, funding opportunities, and a clearer path to consistency in my trading journey. If you’re just starting out, understanding these differences can help you make an informed decision on which market aligns best with your trading style and financial goals.

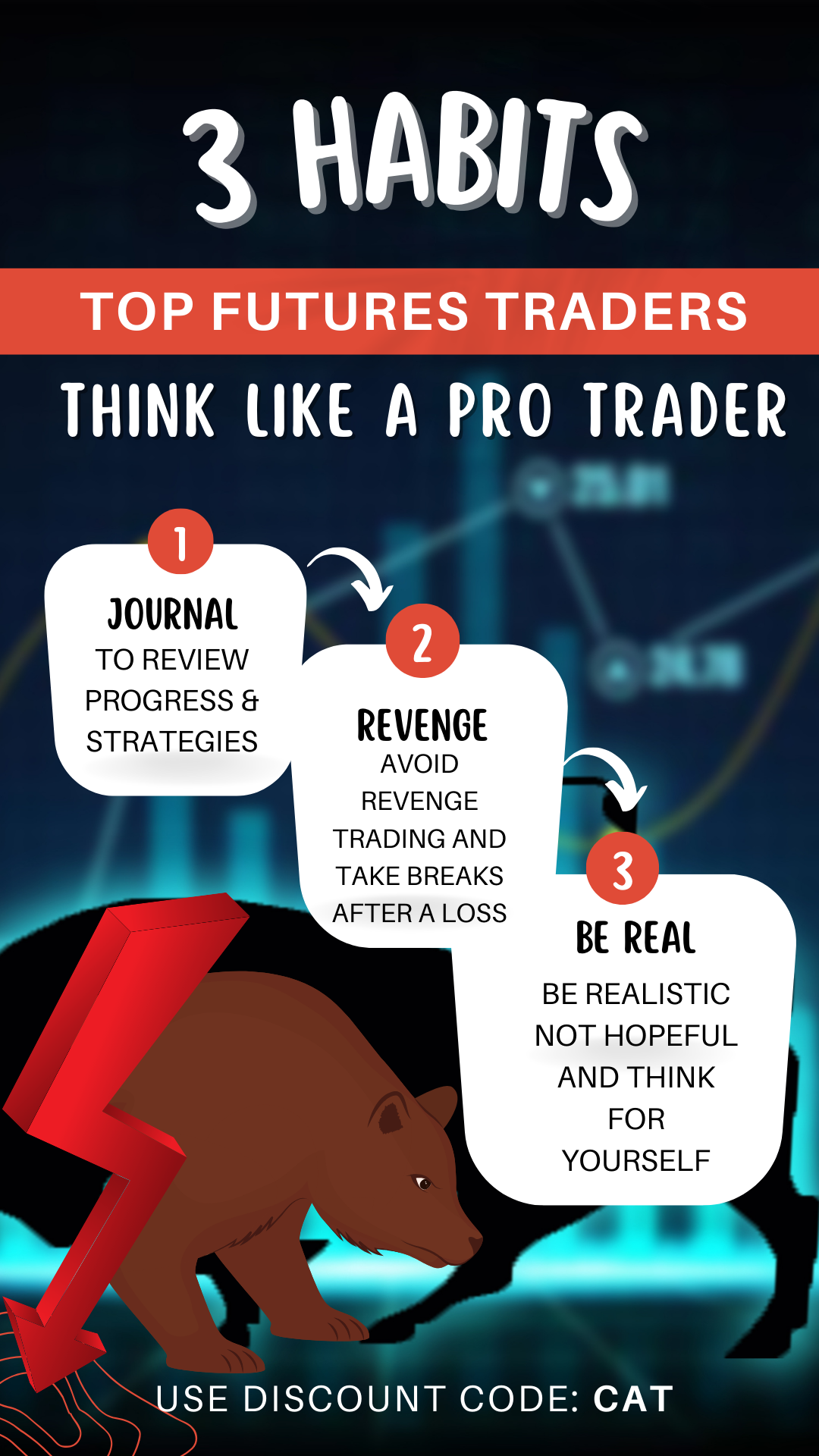

Top 3 Prop Firms I Use for Futures Trading - Discount Code is CAT

Final Thoughts: Futures Vs. Options Trading

Choosing between futures and options depends on your risk tolerance, investment strategy, and experience level. Regardless of which you choose, it's essential to have a solid risk management strategy and a clear understanding of the market.

Are you ready to start trading? Make sure to practice with a demo account before risking real capital and educate yourself on the intricacies of both futures and options!

Read Articles Similar to Futures Vs. Options Trading

- How to Choose a Futures Trading Prop Firm 2025

- Instant Funding Prop Firm - Risk or Opportunity

- Trading Video using Prop Firm and NinjaTrader ATM Strategy

- Fast Payout Prop Firms

- Technical Analysis for Prop Firm Trading

- Low Cost Futures Trading Prop Firm

- How to Join Futures Trading Prop Firm with Low Fees

- The Influence of Economic Data in Futures Markets

- How Prop Firms help Manage Risk in Futures Trading

- The Compounding Effect in Day Trading Futures using Prop Firms

- Best Prop Firms List

- Prop Firms that Allow Copy Trading

- Day Trade Futures with $50

- Trading Futures with Prop Firms

- Prop Firms that Accept USA Traders (2024)

Do you have any comments about how to choose a futures trading prop firm? Please post them below.

Thanks again! Don't hesitate to share or repost this article.

AFFILIATE AND NETWORK MARKETING DISCLOSURE: This video and description may contain affiliate links, which means that if you click on one of the product links, I’ll receive a small commission. I won't put anything here that I haven't verified and/or personally used myself.

Stay connected with news and updates!

Join our mailing list to receive Real Talk with Catina newsletter.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.